Are you a business owner?

WHAT IS ERTC?

The ERTC can be a game-changer for SMBs

Small and medium-sized businesses (SMBs) play a vital role in the US economy, accounting for over 99% of all businesses and providing jobs for millions of Americans.

Despite the challenges posed by the pandemic, SMBs have shown remarkable resilience and adaptability.

According to a recent report by the National Small Business Association (NSBA), 64% of SMBs reported being either very or somewhat confident about the future of their businesses. This optimism is backed by data showing steady growth in the number of new business applications and a strong rebound in consumer spending.

However, despite the positive outlook, many SMBs are still struggling with cash flow and workforce retention. The good news is that there is a powerful tool that can help eligible businesses overcome these challenges: the Employee Retention Tax Credit (ERTC).

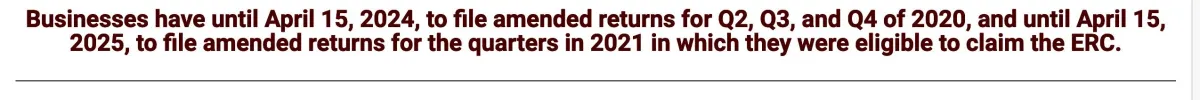

The ERTC was created by the Coronavirus Aid, Relief, and Economic Security (CARES) Act and expanded by subsequent legislation. It provides eligible businesses with a refundable tax credit of up to $26,000 per employee for wages paid between March 12, 2020, and December 31, 2021.

There are various criteria to qualify for the ERTC such as (BUT not limited to) a significant decline in gross receipts, partial or full suspension due to COVID-19, shortages, delays of supplies, etc.

The ERTC can be a game-changer for SMBs looking to grow and scale their businesses. By providing substantial relief for payroll expenses, businesses can free up cash flow to invest in new products, marketing, and technology.

Additionally, the ERTC can help businesses retain their workforce by providing an incentive to keep employees on the payroll. This, in turn, can lead to increased productivity, customer satisfaction, and loyalty.

If you're an eligible business, don't miss out on the ERTC! The application process can be complex, but there are resources and services available to help you navigate it.

The IRS has published detailed guidance on eligibility, calculation, and reporting requirements, and there are also tax professionals who can assist you with the process.

By taking advantage of the ERTC, you can position your business for growth and success in the post-pandemic economy.

WHAT CAN BUSINESS OWNERS DO?

1️⃣ Assess Your Eligibility

Determine if your business meets the criteria for the ERTC, such as but not limited to: revenue decline, capacity restrictions, supply chain disturbances, travel restrictions, commercial disruption, group gathering limitations, full & partial shutdowns, customer or jobsite shutdowns, remote work orders, customer or vendor restrictions, etc.

This can be a critical step in understanding your potential benefits and whether you qualify.

2️⃣ Gather Documentation

Collect the necessary documents, including payroll records, financial statements, and relevant tax forms, to support your ERTC claim. Having organized and accurate documentation will streamline the application process and ensure you can provide the required information.

3️⃣ Seek Professional Assistance

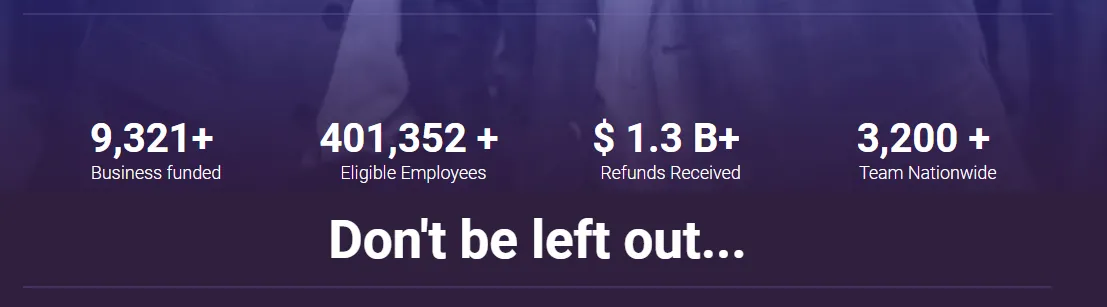

The process and documentary requirements for ERTC can be overwhelming. Consider consulting with tax professionals like ERTC EXPRESS to ensure accuracy and maximize your ERTC benefits.

ERTC EXPRESS can guide you through the application process, help you navigate any complexities, and optimize your tax credit claim. Their expertise will give you peace of mind and confidence in your submission.

Don't let this opportunity slip away!

By claiming the ERTC, you can boost your business's financial health and ensure a strong foundation for the future. Whether it's investing in new equipment, expanding your team, or implementing innovative strategies, the ERTC can provide the necessary support.

As SMBs are on the rise in the USA, the ERTC can be a powerful tool to help eligible businesses grow and scale. Don't hesitate to explore this opportunity and take advantage of the support available.

To learn more about the ERTC and determine your eligibility, simply START HERE.

ERTC EXPRESS' team is ready to assist you and answer any questions you may have.

Together, let's seize this opportunity and thrive in the post-pandemic era!

Let's continue to drive the economy forward and build a brighter future for all.

DISCLOSURE

We promote the services of ERTC EXPRESS because we trust and believe in its mission of primarily supporting businesses navigate the complex Employee Retention Tax Credit process and get the highest possible funding to restore the normalcy of their operations. ERTC EXPRESS is also the first and largest national ERTC-only company. All of its triple team of accountants, lawyers, and executive account managers are all based in the USA with its main location in Tampa, FL.

This website is an affiliate/field agent for ERTC EXPRESS, and is owned and operated by:

ALD Media LLC

California, United States

Contact number: (818) 806-8296

Thank you for your support!